Challenge

Our client, PTSB, is one of the leading financial institutions in Ireland. As a personal financial services provider, it sought an intelligent solution that would help to protect its customers from a rising volume of smishing scams.

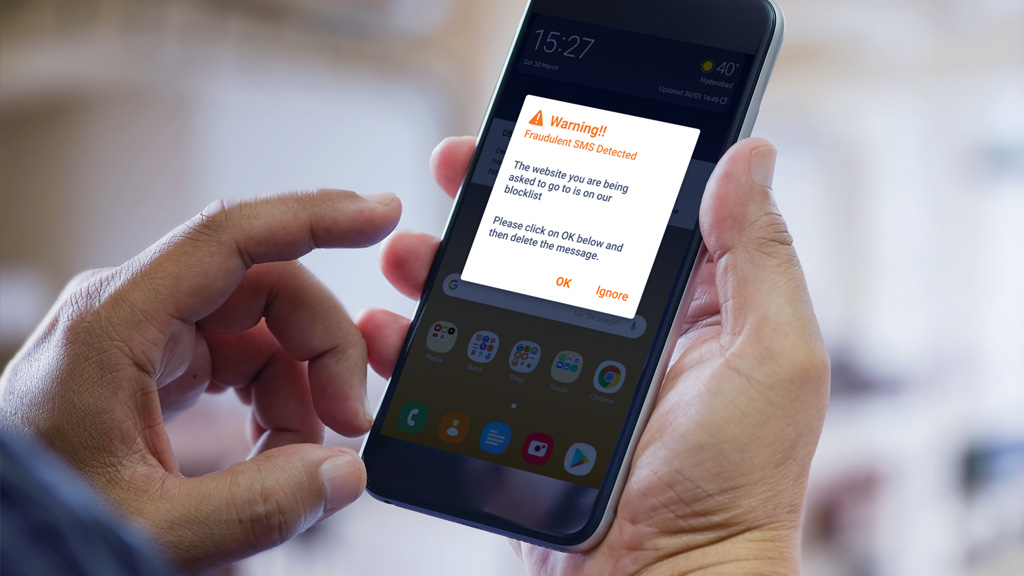

Smishing – phishing scams that are carried out via SMS – has become commonplace for banking customers today. Individuals receive text messages purporting to be from trusted sources such as their bank, delivery companies, or even a loved one. Such messages often contain a call to action encouraging the individual to click on a URL link that leads to a fraudulent website designed to steal card or bank account details.

Retail banks, along with global law enforcement, have warned banking customers to be on high alert to smishing scams, which can have devastating financial consequences. Recent figures from the Banking and Payments Federation Ireland (BPFI) found that incidents of card payment fraud and scams cost Irish consumers €85m in 2022, an increase of 8.8% compared with 2021.

Expleo’s mission was to create a security feature building on our initial Hackathon solution which could help to protect PTSB customers when they receive a text message from potential scammers.

Solutions

Using design thinking and an innovation accelerator approach, ExpleoProtectUS was developed after Expleo determined an urgent need in the marketplace for such a solution, following months of desirability, viability and feasibility research with banks, customers, mobile network operators, SMS security providers and other expert stakeholders.

Expleo’s vast experience in software development allowed us to collaborate with PTSB to create PTSB Protect within nine months. A world-first anti-smishing solution, PTSB Protect leverages the ExpleoProtectUS software, which was conceived and developed as part of our first Hackathon in November 2020. The team at Expleo developed a security functionality which integrates into existing mobile banking apps and is installed as an update. The bank’s customer can then opt in to all inbound SMS messages being scanned after installation, and the software then uses intelligent systems to determine when a customer has received a text message from a fraudulent source and blocks that message.

The customer’s personal information is always protected and no information from the scanned messages or the device is retained or shared by or with PTSB or Expleo. As a demonstration of how unique this technology is, we have a European patent application for the ExpleoProtectUS Android mobile app client.

Our customers’ peace of mind and security are of the utmost importance to us at PTSB and we want to ensure that we are doing everything that we can to protect them from falling victims to cruel scams. That is why we are delighted to launch PTSB Protect as another step in our commitment to the security of our customers. Ably delivered by Expleo, it is an innovative world-first that uses advanced technologies to benefit society. We, and our customers, now have greater peace of mind in the knowledge that our customers are better protected from smishing scams than ever before.

Benefits

The solution is the only offering of its kind which can be installed directly onto a mobile phone – making it the optimum solution to combat SMS fraud.

There are multiple benefits for the bank and the customer. These include:

- Reducing the success of smishing attacks. This saves money for both the consumer and the bank, while also reducing the workload on the bank’s fraud department.

- Giving customers peace of mind that their bank cares about protecting them and that all precautions are being taken to do so.

- Protecting vulnerable and less tech-savvy customers; the bank and the software are now assisting them in determining the legitimacy of messages.

- GDPR and data privacy concerns are simply addressed by the fact that no data leaves the mobile phone. The customer consents to scan all inbound SMS messages after the software upgrade.

Developed for the banking industry, ExpleoProtectUS can also help to protect customers and end-users across the financial services, insurance, retail, and government/public services sectors.