Future banking.

Intuitive, agile and secure

Today’s hyper-competitive banking landscape is providing the impetus for incumbents to embrace a culture of agility and deliver intuitive, elite-grade customer service. There is a pronounced need for system modernisation and automation to secure transactions, reduce costs and adapt to rapidly changing customer expectations.

Expleo helps you fast-track innovation through each step of your value chain, enabling you to scale at pace and accelerate your speed to market.

Hyperautomation with Expleo

Solutions to fast track your innovations

Digital Revolution

Ever-changing customer expectations: lead the digital revolution in finance

Digital technologies have transformed almost every aspect of modern life and business, evolving customer expectations for good. Successful banking and financial services providers are getting agile and nimble to adapt to these rapid changes and technologies with ease. They are upgrading legacy systems and technologies with a blend of software, process improvements and partnerships that are fine-tuned to meet current and future market needs. Expleo’s industry knowledge combines with practical experience in system and process implementation and adoption. Clients gain the insight and skills they seek to expand their customer base and seize new business opportunities across a spectrum of innovative and intuitive digital services.

Cloud migration and operations

From horizon technology to business as usual

Cloud is no longer the next big thing. It’s right here, right now. Accelerated by the global pandemic and growing cybersecurity concerns, providers of financial services are also shifting their systems and processes into the cloud to ensure smoother performance and to drive operational efficiency. The transition to cloud offers adaptability, scalability, and speed, while future-proofing their business. As a trusted partner with deep domain and technology experience in cloud migration, Expleo brings a wide set of services from strategy to implementation in Cloud and DevOps. Expleo has been helping clients identify the right model to adapt from their on-premises systems to the cloud, quickly and reliably. The objective is to equip our clients and partners to meet fast-changing consumer demands and stay ahead of the curve in their innovation and transformation journey.

Legacy Modernisation

The clock is ticking for end-of-life systems the clock is ticking for end-of-life systems

Faced with disruption from digital, data-driven business models, banks and financial institutions are feeling the stress of legacy technology. Delays in releasing new features leave incumbent brands vulnerable to fintech innovations. Maintenance costs are rising. By upgrading archaic systems and obsolete technologies, modern enterprises can meet customer expectations for agility, reliability and performance, and deal with urgent issues such as scaling. Expleo’s expertise in core transformation projects helps financial services providers to optimise the quality of their system offerings and products. By ensuring a seamless transition, clients can take advantage of technological advancements such as omnichannel banking and seamless partner integration that are proven to propel business profitability.

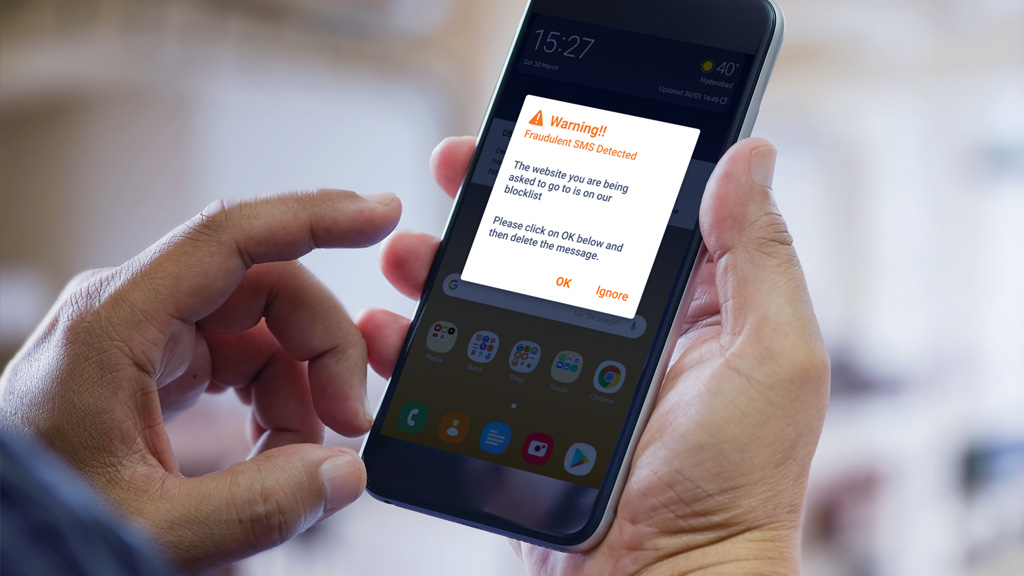

Zero Trust

Zero Trust grows customer trust: how to ensure security, privacy and protection

Banks and financial institutions process billions of transactions every day across their digital channels. In the race for digital advancement, businesses overlook cyber security at their peril. Zero Trust is the new normal in the cyber security space. By removing the human element of trust, the security system demands strict identity verification and authentication for each person and device in the financial institution’s private network, no matter if they are within the business premise or outside. With its own security test centre of excellence, Expleo helps clients to increase visibility into all user activity, improve their credibility and customer trust, while securing their remote workforces.

Data Analytics, AI and Hyper-personalisation

Every customer is different. Their expectations are unique. Whether personal banking or e-commerce, it pays to understand user preferences. Personalised suggestions are proven to improve the adoption rate, while customers are shown to appreciate brands that tailor products to their individual needs. Knowledge creates loyalty. The growth of AI, ML and real-time data analytics has opened the era of hyper-personalization, allowing enterprises to recognise transaction patterns and generate ever-more accurate predictions of customer choice. Expleo brings an extensive track record in data governance and analytics, AI solutions and workflow optimisation, as well as hands-on experience of change management, innovation roadmaps and customer chatbots.

RPA, IPA and Hyperautomation

Find time for improved processing

Banks and financial institutions are struggling to find competitive advantage in an increasingly saturated business world. Everyday processes are logjammed by human errors, while innovation is delayed or even shelved due to rising operating costs. Process automation including RPA, IPA, and hyperautomation, gives time back to businesses, releasing them to reduce manual effort and improve the customer experience by processing repetitive tasks. Software robots allow companies to scale operations, lower infrastructure costs and decrease the hours lost through rework. Expleo’s core expertise and advancement in the field of RPA and other process automation enables our clients to cut down on expenses and improve their process efficiency.

Wide range of Services to drive your success

Innovation Management & Solutions

With our open innovation approach and cross-functional engineering-technology expertise, we help R&T managers accelerate go-to-market innovations, stay ahead of the competition, and achieve Sustainable Development Goals (SDGs).

Services

- Design thinking & lean startup

- Innovation lab

- Sustainable design & life cycle assessment

- Go-to-market strategies

- Hydrogen & energy solutions

- Autonomous mobility

- E-mobility

Transformation Consultancy

Our management consulting services are designed to help executives and managers navigate complex challenges across sectors, including automotive, aerospace, railway, defence, energy, banking, and insurance.

Services

- Business Agility & Lean

- Strategic Consultancy & CX

- Digital portfolio management

- New business model & digital services

- Climate & Environment strategy

- People & change management

- Project management office

- Training & upskilling

Digital Transformation

We help leading industries successfully navigate complex digital transformations and deliver measurable ROIs. Our services are designed to meet the needs of IT and digital departments, allowing them to better understand business operations and provide value revenue generation.

Services

- Business analysis & transformation

- Big data, analytics, AI & Advanced Algorithms

- Hyperautomation

- Digital twin & digital thread

- Cloud-based Dev

- DevSecOps as a service

- IoT & edge computing

- Advanced UI & User experience

Product Engineering

We deliver comprehensive product engineering services to the automotive, aerospace, defence, railway, and energy industries. From design to certification, our cross-functional engineering teams ensure on-time, on-budget delivery of products, that meet end-user requirements.

Services

- Model-based Systems engineering

- Advanced Materials & processes

- Mechanical product design & engineering

- Embedded systems & software

- FPGA & electronics

- RAMS & ILS engineering

- Product & OT cybersecurity

- Product & process life cycle management

Manufacturing & Supply Chain

Our consultants and engineers help manufacturing companies achieve superior performance by securing supply chains and designing efficient tools and processes for operations.

Services

- Industry 4.0 Implementation

- Data-driven manufacturing

- Manufacturing engineering

- Mechanical tooling solutions

- Supply chain excellence

- Supply chain predictive analytics

- Environment, health & safety operations

Quality & Testing

We support our clients through design, build, and operation to implement quality processes and ensure flawless products and bug-free applications.

Services

- Quality management systems

- Programme & project quality

- Product testing & validation

- Manufacturing quality

- Software quality assurance

- Software quality engineering

Customer Support & Maintenance

By providing predictive data analytics, maintenance strategy and processes, automation of customer service workflows, and serial engineering-RAMS support, we support leading manufacturers and service providers to obtain the highest end-customer satisfaction the lowest Total Cost of Ownership (TCO).

Services

- Omnichannel customer data analysis

- Predictive maintenance

- Customer support & serial engineering

- Life cycle cost optimisation

- Software monitoring & maintenance